Nonprofit organizations, like their for-profit counterparts, often seek to motivate their leadership teams to achieve ambitious goals. For 501(c)(3) public charities, however, structuring executive compensation, especially performance-based bonuses, requires careful attention to IRS regulations and best practices to ensure compliance and protect tax-exempt status.

Can a 501(c)(3) Offer Performance Incentive Bonuses?

Yes. The IRS permits 501(c)(3) organizations to offer performance-based incentive bonuses to CEOs and key staff, including bonuses tied to metrics such as membership growth and achieving a balanced or surplus budget. However, these arrangements must be carefully structured to avoid regulatory pitfalls.

Five Key IRS Requirements and Best Practices

1. Reasonable Compensation

All compensation, including bonuses, must be reasonable—that is, not more than what would be paid for similar services by similar organizations under similar circumstances. The IRS considers the total compensation package (salary, bonuses, benefits, etc.) when evaluating reasonableness.

2. No Private Inurement or Excess Benefit

The organization’s net earnings cannot inure to the benefit of private individuals (such as executives or board members). If compensation exceeds reasonable value, the excess is considered an “excess benefit transaction,” subject to excise taxes for both the recipient and participating managers, and may jeopardize the organization’s tax-exempt status.

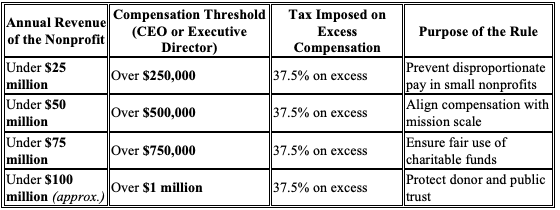

Example: Puerto Rico’s Executive Compensation Limits for Nonprofits

In addition to federal IRS rules, some jurisdictions have their own oversight mechanisms to ensure nonprofit executive compensation remains proportionate to organizational size. For instance, Puerto Rico law imposes an additional 37.5% tax on excessive executive compensation when the total pay surpasses certain thresholds relative to annual revenue.

Note: These thresholds apply to nonprofits operating under Puerto Rico’s tax code and are intended to discourage excessive executive compensation in relation to organizational size and purpose. Nonprofits exceeding these limits may be subject to additional taxes unless the compensation is justified as reasonable and mission-aligned.

3. Independent Approval and Documentation

Compensation arrangements should be approved in advance by an independent, disinterested board or committee. The board should gather and rely on comparability data—information about compensation for similar positions at similar organizations in the same geographic area. The decision-making process and supporting data must be contemporaneously documented.

4. Objective, Mission-Consistent Criteria

Performance bonuses should be based on objective, measurable criteria that further the organization’s exempt purposes. While financial metrics (like membership growth or net income) are permissible, they should not incentivize behavior that undermines the organization’s charitable mission.

5. Internal Controls

Robust internal controls and clear policies help prevent excess benefit transactions and demonstrate good governance to the IRS and the public.

How to Structure a Compliant Bonus Plan

- Define Clear, Measurable Goals: Tie bonuses to specific, objective outcomes (e.g., a set percentage increase in membership, achieving a balanced budget).

- Benchmark Compensation: Use salary surveys and compensation studies to ensure total pay is in line with similar roles at comparable organizations.

- Independent Review: Have an independent committee or board (with no conflicts of interest) review and approve the plan.

- Document Everything: Keep detailed records of the decision-making process, the data reviewed, and the rationale for the compensation package.

- Review Annually: Reassess compensation regularly to ensure ongoing reasonableness and alignment with the organization’s mission.

Authoritative Sources for Further Reading

- Internal Revenue Code Section 4958 and related Treasury Regulations: These set the legal framework for excess benefit transactions and reasonable compensation.

- IRS Private Letter Rulings and Revenue Rulings: These provide insight into how the IRS evaluates specific compensation arrangements.

- Professional Articles: Resources such as “Internal Controls and Exempt Organization Executive Compensation Arrangements” (The Tax Adviser) and “The Importance of Getting Nonprofit Compensation Right” (Tax Notes) offer practical guidance and best practices.

Conclusion

Performance incentive bonuses can be a powerful tool for motivating nonprofit executives, but they must be structured with care. By following IRS guidelines, benchmarking compensation, ensuring independent oversight, and documenting every step, your organization can reward strong leadership while safeguarding its tax-exempt status and public trust.

If your board is considering implementing or revising an executive bonus plan, consult with a qualified CPA or nonprofit attorney to ensure compliance and best practices.